Business Insolvency Company: Custom-made Solutions for Business Financial Obligation Monitoring

Business Insolvency Company: Custom-made Solutions for Business Financial Obligation Monitoring

Blog Article

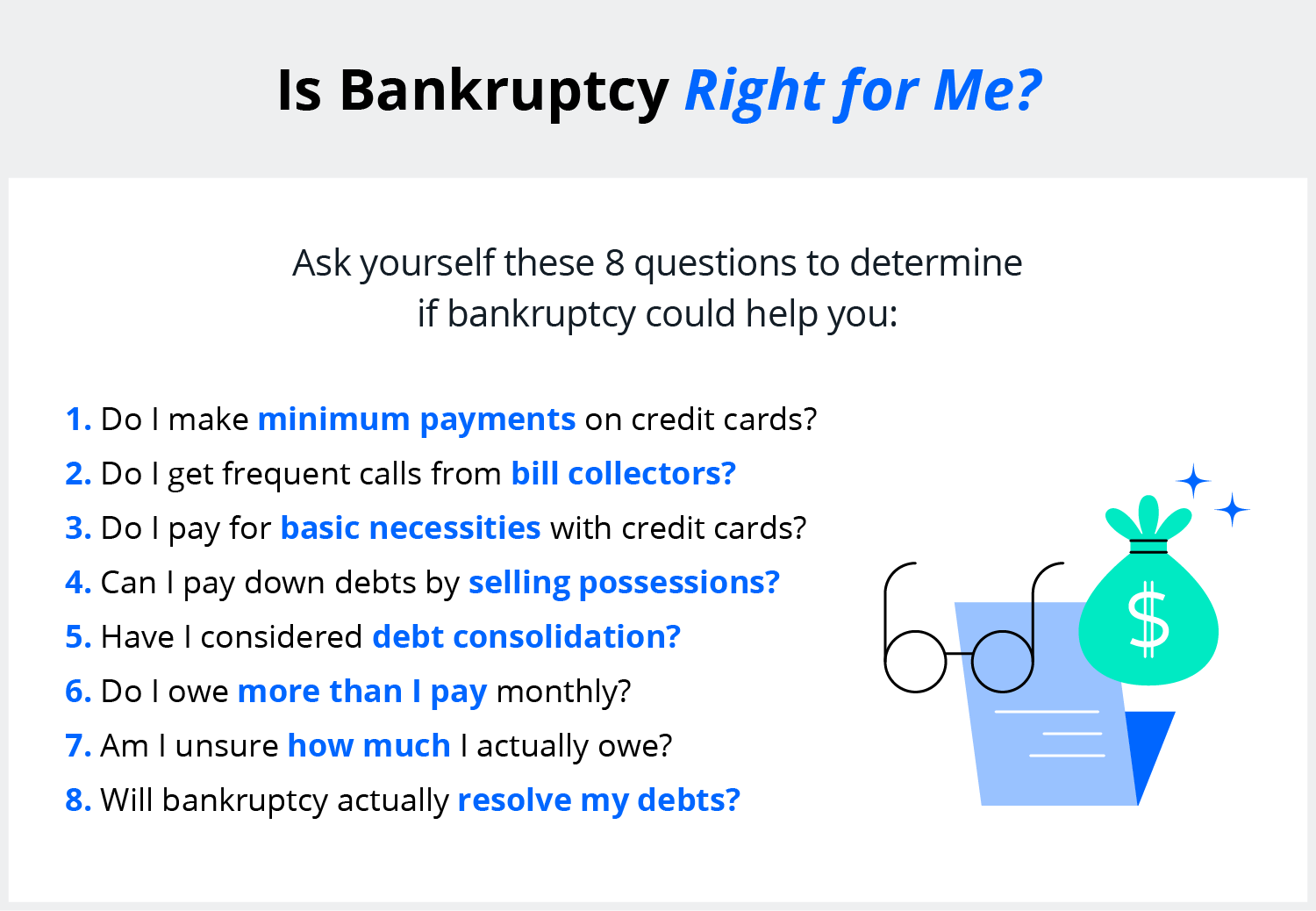

Discover the Key Benefits and Advantages of Making Use Of Insolvency Solutions for Your Economic Scenario

Navigating economic challenges can be a daunting task, specifically when confronted with impossible financial obligations and unclear fiscal futures. In such demanding circumstances, seeking the experience of insolvency services can use a lifeline to individuals and companies alike. These specialized solutions provide a variety of options made to relieve the worry of debt, restructure economic obligations, and lead the way in the direction of a more stable monetary structure. By comprehending the crucial advantages and benefits related to using insolvency services, people can gain valuable insights right into just how to resolve their monetary dilemmas efficiently and proactively.

Understanding Bankruptcy Solutions

When dealing with financial difficulties, people and companies can profit from recognizing insolvency services to navigate their situation properly. Bankruptcy solutions incorporate a variety of options developed to aid companies and people resolve monetary obstacles and gain back security. These solutions usually include financial debt restructuring, settlement with financial institutions, possession liquidation, and insolvency process.

By seeking help from insolvency specialists, people can get a clear understanding of their monetary alternatives and establish a strategic plan to address their debts. Insolvency experts have the know-how to assess the financial situation, recognize the origin of the bankruptcy, and suggest one of the most appropriate strategy.

Additionally, recognizing bankruptcy services can supply people with beneficial insights into the lawful ramifications of their monetary scenario. This expertise can aid people make informed choices about how to proceed and shield their passions throughout the bankruptcy procedure.

Debt Consolidation Solutions

Checking out reliable debt combination options can give people and organizations with a streamlined approach to managing their monetary responsibilities. Financial obligation debt consolidation entails combining multiple debts right into a solitary funding or layaway plan, usually with a reduced rates of interest or extended repayment terms. This approach can aid streamline finances, minimize the danger of missed payments, and possibly reduced monthly settlements.

One usual financial obligation combination remedy is a financial debt combination financing, where businesses or individuals obtain a round figure to repay existing debts and after that make solitary regular monthly payments in the direction of the new lending. One more alternative is a financial obligation management plan, where a credit score counseling firm discusses with creditors to reduced rate of interest or forgo fees, permitting the borrower to make one combined monthly settlement to the agency.

Discussing With Creditors

Negotiating properly with lenders is an essential action in dealing with economic problems and locating possible remedies for debt payment. When encountering bankruptcy, open interaction with creditors is crucial to reaching mutually beneficial contracts. By launching discussions with creditors at an early stage, people or businesses can demonstrate their determination to attend to the financial debt issue sensibly.

During settlements, it's necessary to offer lenders with a clear summary of your economic circumstance, including income, costs, and possessions. Openness constructs trust and enhances the possibility of getting to a beneficial end result. In addition, recommending practical repayment plans that think about both your monetary abilities and the lenders' rate of interests can lead to successful contracts.

Personalized Financial Assistance

Establishing a solid foundation for financial healing entails looking for individualized economic support why not try here customized to your details circumstances and objectives. Business Insolvency Company. Individualized monetary support plays an important function in navigating the complexities of bankruptcy and creating a critical strategy for reclaiming economic stability. By working very closely with a monetary expert or insolvency expert, you can obtain useful understandings right into your monetary circumstance, identify locations for renovation, and develop a roadmap for attaining your financial objectives

Among the vital advantages of individualized financial support is the possibility to obtain tailored advice that considers your one-of-a-kind monetary circumstances. A monetary advisor can examine your income, assets, financial obligations, and expenditures to provide personalized referrals that line up with your objectives. This personalized strategy can assist you make educated decisions, prioritize your monetary commitments, and produce a sustainable monetary prepare for the future.

Furthermore, individualized economic guidance can provide continuous support and responsibility as you function towards improving your financial situation. By partnering with an educated expert, you can gain the confidence and proficiency needed to conquer monetary obstacles and build a stronger financial future.

Path to Financial Recovery

Browsing the trip in the direction of economic recuperation needs a calculated approach and regimented financial management. To embark on this course efficiently, individuals should first assess their existing economic circumstance adequately. This entails recognizing the degree of financial obligations, assessing income sources, and determining costs that can be cut to reroute funds in the direction of debt settlement or financial savings.

When a clear photo of the economic additional info landscape is developed, creating a realistic spending plan ends up being critical - Business Insolvency Company. Budgeting enables the allowance of funds towards financial obligation repayment while making sure that essential expenditures are covered. It likewise offers as a tool for tracking progress and making essential modifications in the process

:max_bytes(150000):strip_icc()/Term-b-bankruptcy-50ca3cfd9f4146e78eabe03b64704456.jpg)

Verdict

To conclude, using insolvency services uses various advantages and benefits for individuals encountering financial troubles. These services provide financial debt combination solutions, aid discuss with lenders, offer individualized financial advice, and lead the way towards monetary recovery. By looking for out insolvency services, individuals can take aggressive steps in the direction of improving their economic situation and attaining long-lasting stability.

By working collaboratively with lenders, companies and people can browse difficult economic circumstances and pave the means towards a much more secure monetary future.

One of the key advantages of customized economic guidance is the chance to receive customized advice that considers your special financial situations. These solutions provide financial debt combination options, help work out with lenders, supply individualized financial support, and lead the way towards monetary recuperation.

Report this page